Capital Gains. We all know about them. We all hate them. I believe everyone knows about your one-time capital gains write off of $250,000 for an individual and $500,000 for a married couple when selling your primary residence. There are some exclusions here. And they can save you a bundle. Did you know that you can defer your taxes for up to 30 years? This is a wealth building tool that allows you defer taxes and keep more money in your pocket. It is known as an installment sale tax treatment or monetized installment sale. Now, there are rules to making a sale like this work. The most important one is that you have to set it up before your home closes. And, this can take time. Setting up a tax deferment can take up to two months. So plan early.

Here is a link to a Kiplinger article that gives you the general idea of what it is and how it can benefit you: Are Capital Gains Taxes Keeping You From Selling Property? | Kiplinger.

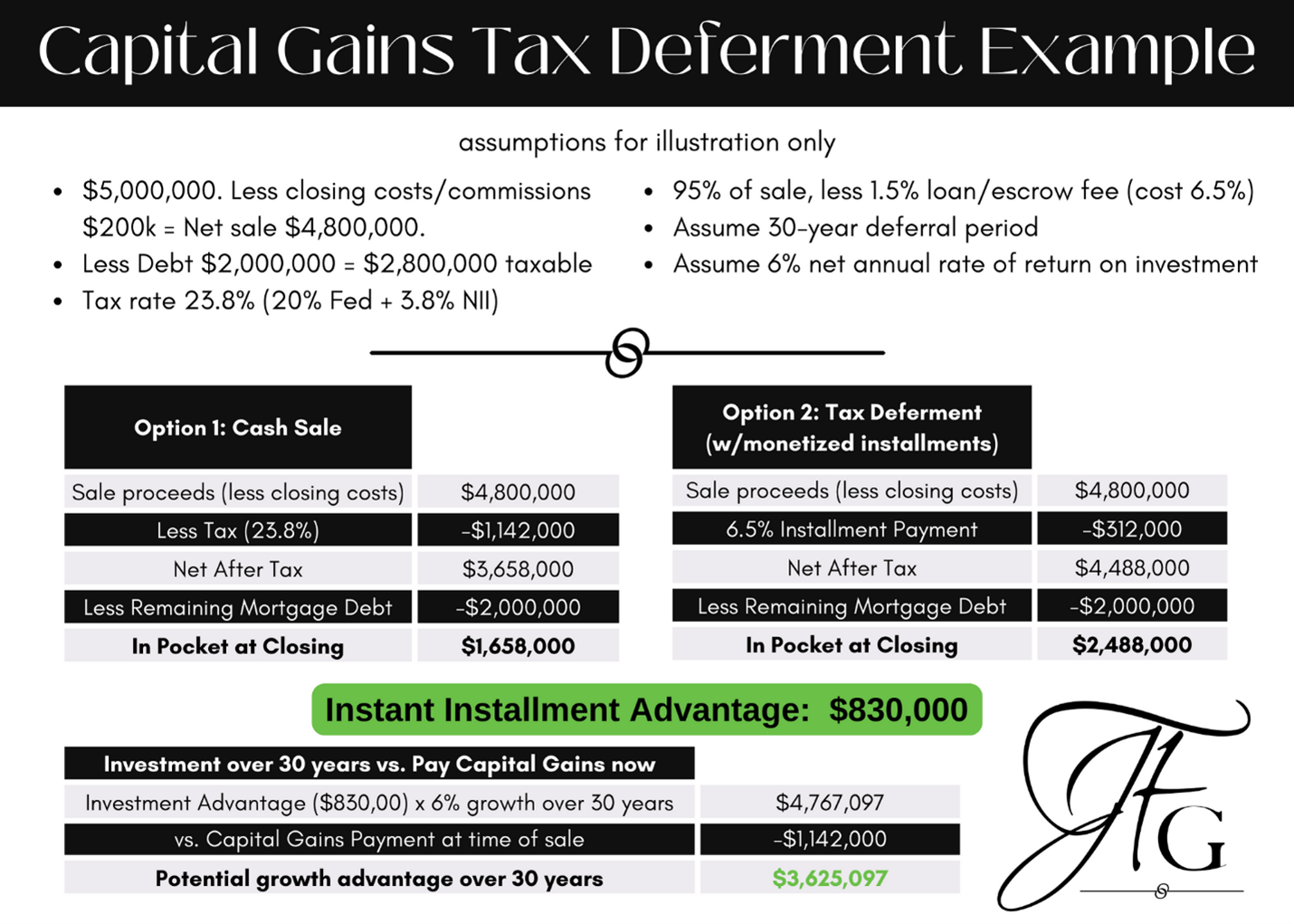

Let’s take a very simplistic look at how this tax deferment could work. I’m going to use round-ish numbers to make the math easier:

The numbers are powerful. Instantly you have the ability to realize tens of thousands, if not hundreds of thousands in gains. If you invest those dollars, the growth is exponential. Add in the inflationary effect of 30 years, and your tax burden goes down from $1 to $.40. All it takes is someone who knows what they are doing and some planning ahead.

Are you intrigued? Want more information? I have a Power Point Presentation I can share with you and discuss what it all means. If you are selling and would like to take advantage of this extraordinary tax and wealth benefit, I can introduce you to my network of contacts that can work with you. Not everyone knows how to structure this kind of sale. Lucky for you, my team and I do.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link